The Barbell: A Weighty Strategy

While interest rates have hovered in a lessthan- exciting range for some time, it may be tempting for an investor to sit on the sidelines, waiting for higher yields and lower prices. After all, the bond market maintains an inverse relationship between yield and price, as one goes up, the other goes down.

Currently, the yield curve—which is a graphical relationship between yield and maturity among bonds of different maturities and the same credit quality—is flat or even slightly inverted. This means that the difference between the yields that are available to investors looking at shorter-term securities versus long-term maturities is much less than has been historically available.

More specifically, a higher yield has traditionally been the reward for investors who choose to take on the additional risk of investing in longer-term securities. With that reward now diminished, this atypical circumstance can make it even more difficult for investors to commit to one part of the yield curve.

Investors are not alone in their uncertainty. In fact, despite the Federal Reserve continually raising short-term rates between June of 2004 and August of 2006, long-term rates have defied logic by falling, creating the flat curve. Foreign investors purchasing U.S. debt and the volatility of oil prices are just some of the contributors to this ongoing conundrum.

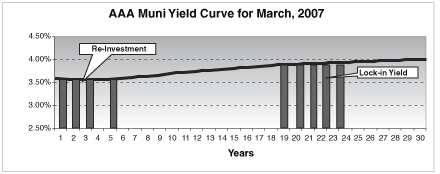

Keeping this unprecedented environment in mind, you might want to consider implementing a barbell—a bond investment strategy that concentrates holdings in both short-term and long-term maturities. The strategy combines a short-term ladder, such as one to five years, with a long-term ladder, such as 20 to 25 years.

A laddered portfolio is designed to provide diversification, while minimizing interest rate risk. A ladder is developed by dividing the total investment amount evenly among different bonds maturing in different years—such as one, two, three, four and five years. As each defined interval of principal is returned, various reinvestment opportunities are created over that timeframe.

The barbell version of a laddered portfolio establishes a reinvestment opportunity with the short-term bonds in the event of rising rates, but hedges against stagnant or lower rates as longterm bonds lock in the yield available today.

For a clearer understanding, take a look at the chart to the above. In addition to creating a re-investment opportunity and locking in current interest rates, this strategy also provides an intermediate average maturity, which typically is the more common investment range. Therefore, the barbell can be an alternative to the traditional intermediate ladder that ranges from five to 15 years.

Please note that all bonds are subject to market fluctuation and may be worth more or less than their original cost if sold prior to maturity. Bonds also may contain call features which can affect yield and result in early redemption. This investment strategy can be applied to taxable and tax-exempt securities. To learn more about barbell bond portfolios, contact your financial advisor. IBI

Currently, the yield curve—which is a graphical relationship between yield and maturity among bonds of different maturities and the same credit quality—is flat or even slightly inverted. This means that the difference between the yields that are available to investors looking at shorter-term securities versus long-term maturities is much less than has been historically available.

More specifically, a higher yield has traditionally been the reward for investors who choose to take on the additional risk of investing in longer-term securities. With that reward now diminished, this atypical circumstance can make it even more difficult for investors to commit to one part of the yield curve.

Investors are not alone in their uncertainty. In fact, despite the Federal Reserve continually raising short-term rates between June of 2004 and August of 2006, long-term rates have defied logic by falling, creating the flat curve. Foreign investors purchasing U.S. debt and the volatility of oil prices are just some of the contributors to this ongoing conundrum.

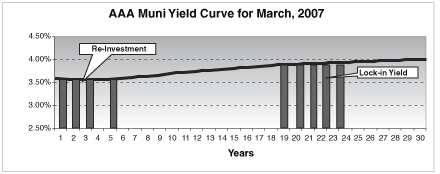

Keeping this unprecedented environment in mind, you might want to consider implementing a barbell—a bond investment strategy that concentrates holdings in both short-term and long-term maturities. The strategy combines a short-term ladder, such as one to five years, with a long-term ladder, such as 20 to 25 years.

A laddered portfolio is designed to provide diversification, while minimizing interest rate risk. A ladder is developed by dividing the total investment amount evenly among different bonds maturing in different years—such as one, two, three, four and five years. As each defined interval of principal is returned, various reinvestment opportunities are created over that timeframe.

The barbell version of a laddered portfolio establishes a reinvestment opportunity with the short-term bonds in the event of rising rates, but hedges against stagnant or lower rates as longterm bonds lock in the yield available today.

For a clearer understanding, take a look at the chart to the above. In addition to creating a re-investment opportunity and locking in current interest rates, this strategy also provides an intermediate average maturity, which typically is the more common investment range. Therefore, the barbell can be an alternative to the traditional intermediate ladder that ranges from five to 15 years.

Please note that all bonds are subject to market fluctuation and may be worth more or less than their original cost if sold prior to maturity. Bonds also may contain call features which can affect yield and result in early redemption. This investment strategy can be applied to taxable and tax-exempt securities. To learn more about barbell bond portfolios, contact your financial advisor. IBI