Your Peoria County Board is taking a proactive approach to transportation infrastructure by addressing head-on the issue of deteriorating county road conditions. Following Benjamin Franklin's advice—"An ounce of prevention is worth a pound of cure"—we want to address this issue while it is still manageable.

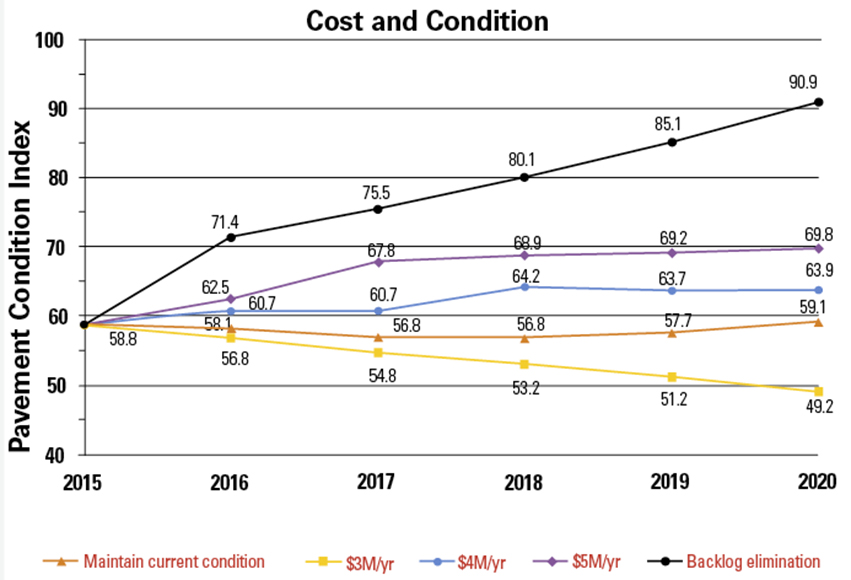

In early 2016, we evaluated our current road conditions and the costs associated with ongoing maintenance and needed repairs. We did not find a rosy picture. Road networks should ideally have a pavement condition index (PCI) in the 70 range or above, and we were at 58.8 PCI. The cost just to maintain current conditions would soon outpace our annual highway department maintenance budget of roughly $3.5 million.

Part of the funding issue stems from declining State of Illinois Motor Fuel Tax (MFT) revenue. While the amount of roads the county maintains has not decreased, over time the state has reduced our percentage share of MFT. In addition, the MFT has not been adjusted for inflation since 1993. The Peoria County Board has also been diligent in its resolve not to raise property taxes. In fact, the county property tax rate has remained flat for more than 10 years.

However, in looking at ways to address our road infrastructure funding, Peoria County found itself with limited options. We could raise property taxes, ask voters to approve a sales tax increase, or lobby the state government to change the law to allow for a local gas tax. In February, we polled 1,000 county citizens—500 inside the City of Peoria and 500 outside the City of Peoria—to hear their input. While the overwhelming majority of respondents did not support a change in state law or a property tax increase, more than 45 percent did find a sales tax increase to be acceptable.

Using this information, the County Board chose to place a referendum on the November 8th ballot for a 0.25-percent retail sales tax increase. It would be used specifically for county road improvements, and automatically end after 15 years. The tax would not be applied to prescription drugs, groceries or titled goods, such as cars or boats.

If passed, Peoria County has already committed to a plan of action, prioritizing road and intersection projects. Roads located within the City of Peoria, once upgraded, would have ownership and maintenance turned over to the City of Peoria through a long-standing intergovernmental agreement.

The total revenue we would expect to gain over 15 years is $67.5 million. We would first issue a $35-million bond, which would pay for the first 10 projects. The remaining five projects, costing an estimated $27 million, would be completed on a pay-as-you-go structure. A map of the proposed projects is on our website, fixthecountyroads.com.

The discussion of budgets and taxes is never a glamorous topic, but the Peoria County Board believes it is deserving of serious discussion and action. And remember, there are many important issues on the November 8th ballot, so please take the time to head to the polls on Tuesday. iBi