With a long, rich history, South Side Bank offers customer-oriented banking services in a community-centered atmosphere.

On January 4, 1922, amongst Peoria’s riverside stockyards and downtown businesses, 203 community investors banded together to establish the first South Side Bank. Over the decades, as its influence grew, the bank gradually expanded to include 13 locally-operated locations throughout the Peoria area.

Mark Joseph has his own sense of pride in serving the local community. The current president and CEO of South Side Bank, he grew up in Peoria, attended Illinois Central College, and has worked at the bank for 23 years. Having lived here all his life, he was an obvious choice to lead this community-oriented bank that’s been a cornerstone of business in central Illinois for more than nine decades.

Do the Right Thing

Through all the ups and downs of the economy in recent years, South Side Bank has thrived by sticking to its conservative lending practices and banking principles. “I think the most important ingredient for South Side Bank to have remained successful, independent and thriving has been… something very simple,” says Joseph. “It starts with doing the right thing by our customers.”

This key ingredient is baked right into its mission statement, which rests on four pillars: being the bank of choice for customers, employees, shareholders and the community. That means providing convenient, ethical and personalized services, as well as developing a positive work environment for its employees. “The way we’ve always done things has centered around taking care of our customers… taking care of our employees, making sure they are trained, skilled… [and] have opportunities to succeed,” he adds.

During the recession of 2008 and 2009, South Side Bank did not need to accept financial assistance from the federal government’s TARP program. “We had always had a very strong capital position, and we didn’t get involved with a lot of the riskier lending that was going on at that time,” Joseph explains. “So [the downturn] didn’t have the same negative effect on our bank and our portfolio as a number of other institutions.”

Keeping It Local

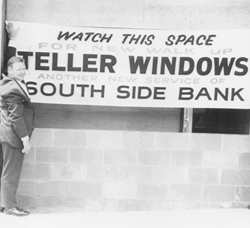

When South Side Bank first opened its doors in 1922, it did so at the same location on Southwest Adams Street in Peoria that remains the bank’s headquarters today. The next morning, a local newspaper wrote about the unveiling, encouraging readers to “keep an eye on the South Side.” They had good reason to pay attention, as the bank has gained a reliable reputation over the years through its commitment to the local community. At its opening, South Side Bank reported a capital stock of $150,000. This year, the bank counted $677 million in assets, and it continues to grow.

Indeed, South Side Bank has stood the test of time—as banks should—and not primarily because of the assets under its control, but for its commitment to staying independent and making a personal connection with its customers. “We love the fact that we’re local. We can be so responsive,” says Emma Vandeveer, vice president of marketing and sales. “If [a customer] wants to come in and talk to somebody… they can walk right in and talk to a decision maker.”

South Side Bank maintains an atmosphere that only a local bank can have. Its employees are approachable because they are aware of the people and goings-on in their own community. “We are such a close-knit group,” Vandeveer continues. “It’s such a family here, and it is unbelievable the passion our employees have—regardless of what level they’re at—about the bank, about each other, and about serving our customers.”

Expanding Its Influence

Over the course of nine decades, South Side Bank has undergone a number of expansions and redevelopments, spreading out to locations all across the city, into Bartonville and Chillicothe, and across the river into Washington, Pekin and East Peoria. In fact, the bank’s symbol, an eagle on a weather vane, signifies its spread of influence in all directions of the compass.

“As we continued to see… that we were growing, our customers liked us, and our brand was successful, we continued to move into areas where we felt there were growth possibilities,” Joseph describes. It has always been in the bank’s best interest, he says, to “expand our footprint” in order to provide more opportunities for its customers. Today, the company has nearly 200 employees at its 13 locations, as well as a mobile banking truck that visits local businesses.

Throughout this expansion, however, there have been just seven company presidents, including Joseph, which offers a sense of stability and helps ground the company in the local community. In addition, the bank and its employees take pride in their involvement with community events, offering support to organizations like Easter Seals, St. Jude, Susan G. Komen Race for the Cure and the United Way. It also works with WMBD-31 to sponsor the Santa Claus Parade, the longest-running Christmas parade in the country. “We’re part of the community,” Joseph stresses. “We feel that the need is always to give back, to be involved… ultimately you’re rewarded, but that’s not why you do it—you do it because it’s the right thing.”

Throughout this expansion, however, there have been just seven company presidents, including Joseph, which offers a sense of stability and helps ground the company in the local community. In addition, the bank and its employees take pride in their involvement with community events, offering support to organizations like Easter Seals, St. Jude, Susan G. Komen Race for the Cure and the United Way. It also works with WMBD-31 to sponsor the Santa Claus Parade, the longest-running Christmas parade in the country. “We’re part of the community,” Joseph stresses. “We feel that the need is always to give back, to be involved… ultimately you’re rewarded, but that’s not why you do it—you do it because it’s the right thing.”

Banking in the 21st Century

Though the principles of lending have remained the same—if not always followed—the banking industry has been transformed in many ways over the years. Today, mobile banking is second-nature, and to many people, going to a physical location to speak to a teller is a thing of the past. “Online banking products and mobile banking specifically… is something that [a] larger and larger percentage of our customers today want,” Joseph explains. “We still have customers that love to come into the bank… and do their business personally, but [many] customers who… don’t have a need that draws them into the bank [would] just as soon do all their business from their home.”

In addition to online and mobile banking, South Side Bank has its own trust and brokerage departments, and it owns Mid-Illinois Insurance Company, a subsidiary that deals with property, life and health insurance. Additionally, the bank’s 50+ Advantage Club program is tailored specifically for older customers. “We provide [members] with activities, with trips, and with seminars to inform them on the newest products, technologies [and] needs,” Joseph says. These additional offerings supplement the bank’s traditional banking services.

Above all, South Side Bank continues to uphold its philosophy of “doing the right thing” for the customer, taking care of its employees and shareholders, and serving as a strong presence in the community. “We are just pleased to be a part of the Peoria area,” Vandeveer emphasizes. “We like it here, and I think that shows.” And you can take that to the bank. iBi