Lower Your Tax Bill Through Charitable Giving

If you could pay just your fair share of taxes, but not leave a tip, would you be interested? Here are three ideas to help your favorite charity… and not leave a tip to the IRS.

- Qualified Charitable Distributions (QCDs). Those over age 70½ may donate their IRA-required minimum distribution (RMD) directly to a qualified charity. Up to $100,000 per year (giving all or just a portion) can be excluded from gross income. These direct donations will count toward your RMD for the year, which can be an excellent strategy to consider if you do not itemize deductions on your tax return. Keep in mind that a donor-advised fund is not a qualified charity for purposes of a QCD.

- Giving appreciated assets. Donating stock held long-term, or other intangible long-term capital gain property, to a qualified public charity allows for a charitable deduction. It also eliminates the capital gain—and associated capital gains tax—from the sale of the security. A donor-advised fund can be used to implement this strategy.

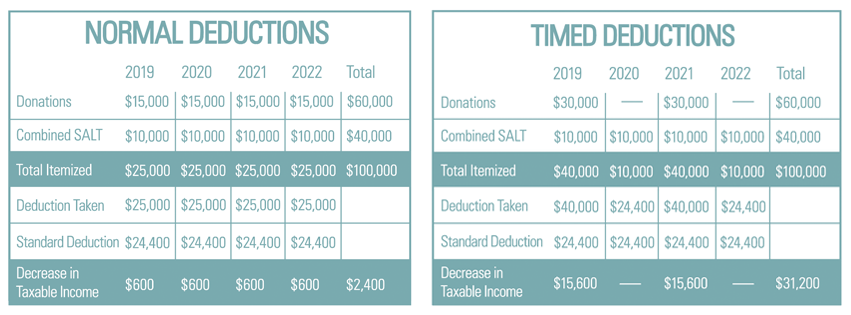

- Timing your donations. The hypothetical illustration in the chart shows a married couple gifting $15,000 to their favorite charities at the end of the year for four years. In this example, state and property taxes (SALT) are more than $10,000 per year, but are capped at $10,000 due to the new Tax Cuts and Jobs Act (TCJA) limitation. The couple’s total itemized deduction for the next four years is $25,000 per year—which is higher than the standard deduction (assuming the 2019 standard deduction of $24,400 stays flat for each of the next four years). Their ability to itemize reduces their taxable income by $600 per year, for a total of $2,400 over the course of four years.

Now let’s look at changing the timing of this couple’s charitable gifting. Can they achieve a higher level of tax savings?

Instead of giving their $15,000 at the end of each year, they “bunch” them in just two tax years—for example, in January and December in two of the years. Thus, in 2019 and 2021, their charitable donation is $30,000 and in 2020 and 2022, it is zero. State and property taxes are still capped at $10,000, and they benefit from the standard deduction in the “off” years.

This reduces their taxable income by $31,200 over the course of four years (using the same assumptions regarding the standard deduction as the previous example). The couple did not donate any more money than originally planned; they just changed the timing of their donations.

There are many other techniques and strategies available to help you save on taxes while gifting to your favorite charity. Please discuss with your advisor to learn what may be right for your unique situation. PM

Daryl Dagit is market manager and financial advisor in the Peoria office of Savant Capital Management. He can be reached at (309) 693-0300.

This is intended for informational purposes only and should not be construed as investment, tax or financial advice. Please consult with your investment, tax, and financial professionals regarding your specific situation.

- Log in to post comments