Trust, Discipline and Steady Growth

For four decades, DVI has adhered to the client-centric values of its founder, offering stability and integrity in the face of financial storms.

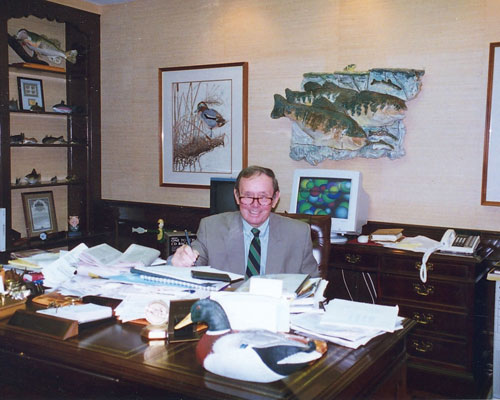

Forty years ago, a man raised in Farmington, Illinois set out to start his own financial advisory firm. With a focus on the individual needs of clients and an investment philosophy emphasizing risk management, David J. Vaughan quickly earned a reputation as a trusted source of financial advice—a grounded voice in an often tumultuous industry.

While David passed away in 2006, his namesake firm, David Vaughan Investments, Inc. (DVI) continues to prosper more than a decade later. DVI is now a team of 26 experienced professionals, providing guidance on $2.6 billion of assets for over 800 clients, with offices in both Peoria, Illinois and Winter Park, Florida. As it marks its 40th anniversary in 2017, DVI remains firmly committed to its founder’s vision, embracing a “dare to be different” investment philosophy, ever committed to its investment manufacturing roots using individual securities—and never failing to give back to the community it calls home.

Do the Right Thing

Prior to forming DVI, David Vaughan began his career owning and managing a firm that provided replacement parts and services to the mining industry. As his professional network grew over the years, so did his interest in wealth management. Having assisted family members and colleagues with investment matters, Vaughan saw an opportunity for a new direction, and in 1977 decided to register with the U.S. Securities & Exchange Commission (SEC) as a Registered Investment Advisor (RIA). It was a novel decision at the time, says Lawrence “Will” Williams, DVI’s current president and CEO.

“Most people didn’t know what the concept of an RIA was—or that it even existed,” Williams explains. “The delivery model for investment advice at that time was primarily from broker-dealers, known as Wall Street wirehouses, bank trust departments and maybe insurance companies… [David] was an early adopter, and he was pretty insightful in terms of grabbing onto an industry trend that in time was going to be extremely successful.”

The RIA designation signifies a fiduciary duty to act in the best interest of clients when providing investment guidance. Most RIAs are compensated on a fee-only basis, rather than receiving commission or other compensation based on product sales, which helps ensure that all financial recommendations are made in the client’s interest—not for the advisor’s potential gain. The concept is quite simple, Williams notes. “Do the right thing. That slogan resonates throughout DVI offices every day.”

After working from his home for many years, Vaughan moved to a small office in Peoria Heights in 1988. Williams joined the firm in 1990; eight years later, it had grown to encompass $1 billion in assets under advisement. “I was the fifth employee,” recalls Patrick Smarjesse, DVI vice president, of his start in 1995. “[It was] the beginning of a growth spurt in the mid-‘90s that really mandated the more formalized structure of both the investment and management committees… in order to manage the firm in a more effective and efficient way. We were very fortunate to add several key employees during this time period—now all DVI shareholders—that contributed to our ability to not only manage our current growth, but also to provide the insights and solutions to future strategic issues.”

In 1993, Vaughan purchased the first and second floors of a historic building at the foot of Forest Park Drive owned by the late Bill Rutherford, the legendary philanthropist responsible for Forest Park Nature Center, Wildlife Prairie Park and other area treasures. DVI moved in the same year, and today it occupies the entire building, thanks in part to the bond Vaughan and his leadership team developed with the Rutherford family. “They were extremely generous,” Williams adds, “[in] their willingness to sell the third floor and allow us to integrate the building into one physical site for us. We still appreciate that gesture today.”

Skin in the Game

Skin in the Game

But DVI’s road to success wasn’t always a smooth one. At the turn of the millennium, technology stocks—in particular, those of “dot-com” companies—were captivating Wall Street and the American people. With the rise of the internet, it seemed everyone had become a day trader. The trend did not go unnoticed by the DVI team, but its business model required sticking to a carefully developed, long-term plan of fundamental investing and risk mitigation. To speculate in tech stocks would go against this deeply-rooted investment philosophy.

“Talk about a time when you really need to have conviction to stick with your discipline, and not roll over and do what is popular!” Smarjesse exclaims. “Lots of soul searching [happened] in this building. Lots of discussions were held at investment committee meetings… but the decision was made to stay the course despite extraordinary pressures to chase the new paradigm.”

Though some called them “intellectual dinosaurs” for passing up what seemed to be a can’t-miss opportunity, this decision turned out to be quite prescient. When the tech bubble burst, DVI managed to avoid the wreckage: $5 trillion in total market value wiped out between March 2000 and October 2002. “Ultimately, you’re going to go through periods of time in which your investment style is in favor or out of favor,” Williams notes. “At the end of the day, people began to recognize that we had the discipline and the patience to manage long-term money through both good times and bad.”

Another moment of truth came amidst the “Great Recession” in the fall of 2008. “There was a lot of fear in the markets,” Smarjesse explains. “We were going into territory, economically, that we’d never previously experienced… save that of the Great Depression. When clients are asking for advice and you’re trying to provide that perspective… we were all leaning on each other.”

All the while, DVI was attempting to provide a steady hand, working to enhance its ancillary client services—with additional focus on Roth IRA conversions, Grantor-Retained Annuity Trusts (GRATs) and tax loss harvesting—to help its clients weather the downturn. That emphasis on creatively finding value while remaining calm in a turbulent economy, Williams says, was “really about trying to be as thoughtful as possible to create something good out of a bad situation.”

Amidst this economic ebb and flow, a devastating blow was delivered to DVI when Vaughan, the sole shareholder, unexpectedly passed away. To carve a new path forward, DVI executed its continuity plan, with the management team taking a lead role in a series of ownership transactions and the resolve to create an independent board of directors. DVI remains privately owned, but in many ways, it has operated like a publicly traded company since Vaughan’s death. All company action is accountable to the board of directors, and each member is a fiduciary.

“It builds confidence,” Williams explains. “It builds confidence in the management shareholders. It builds confidence in the [Vaughan] family, who continue to have a minority equity stake in the company. Everybody is treated equally… all of this is being done as a means of doing the right thing.”

A Firm Footing

While today’s global financial community looks little like the one David Vaughan saw when he founded the firm in 1977, the DVI team has proven to be an unwavering source of stability for its clients. Whatever legislative changes or economic realities come their way, the firm plans to maintain the same philosophy that has set it apart from the beginning.

“Our number-one stakeholder is our clients,” Williams explains. “As we evolve as an organization, the [question] is, how are we going to be able to maintain this business model? How are we going to make sure we can take care of the next generation of our clients in a similar fashion? Being in the intellectual capital business, the solutions are apparent: a next generation of smart investment professionals, more comprehensive financial solutions and the financial resources to pull it all off. The tricky part is the execution on those three tactics, and on that element, only time will tell!”

While working to continue its deliberate growth plan, DVI also carries a longstanding tradition of giving back to its community. From Wildlife Prairie Park to South Side Mission, the firm and its employees are heavily involved in volunteer efforts for a range of charitable organizations. “It was really this fundamental perspective that David [Vaughan] drove in all of us,” Smarjesse notes. “You have to take some ownership here… put a stake in the ground.”

And with a firm footing in Peoria, Williams works diligently with his leadership and advisor teams to keep DVI on a steady path—the same route charted by its founder 40 years ago.

“It’s been an evolution,” Williams declares. “Where we sit here today, it sounds like we had it all mapped out, and that’s not even close to being the truth. But I think over time, we’ve been able to create something that’s very unique and very special.” iBi

For more information, visit dviinc.com.